Finding the right broker can make all the difference if you’re in the market for your dream home, planning to take out a construction loan, or looking to refinance your existing mortgage. The Gold Coast is home to a wealth of good mortgage broker companies and professionals, each with its own unique strengths and specialties. But with so many options to choose from, it can be difficult to know where to start your search.

That’s why we’ve put together a list of the top 8 local mortgage brokers in Gold Coast, based on their reputation, customer service, and expertise in the local property market. Whether you’re a first-time homebuyer or a seasoned investor, these brokers have the knowledge and experience to help you find the best loan with favorable interest rates and terms for you. They’ll even help you with the loan application process.

So, without further ado, let’s dive into our list of the top 5 mortgage brokers in Gold Coast.

1. Your Loan Doctor

Your Loan Doctor is first up on this list. Recognized for its solid commitment to customer-focused services tailored to each client’s needs, the firm is one of the most reliable mortgage broker companies in the area.

Led by Principal George Walklin, an award-winning Mortgage Broker, the team provides both expertise and a personalised approach to mortgage broking. George is a proud member of the Mortgage and Finance Association of Australia and holds a Bachelor of Commerce and a Diploma of Finance and Mortgage Broking Management.

The company values the individuality of every client, evidenced by how they take the time to understand their unique situations, goals, and objectives. George and his team offer customized solutions from a broad network of banks and lenders.

George’s dedication to a holistic and innovative approach has earned numerous five-star reviews and industry awards, such as:

- Finalist in the 2018 The Advisor Better Business Awards for Best Customer Service Individual Category.

- Finalist in the 2018 Mortgage & Finance Association of Australia Excellence Awards for the Young Professional Awards.

- Finalist in the 2019 The Advisor Better Business Awards for Best Community Engagement Program Individual Category.

- Finalist in the 2019 The Advisor Better Business Awards for Rising Star.

- Finalist in the 2019 The Advisor Better Business Awards for Best Customer Service Individual.

- Finalist in the 2021 Australian Small Business Champion Award in the Financial Services Category.

- Winner of the 2021 The Advisor Better Business Awards for Wellness Advocate of the Year.

- Recognized as an “Elite Broker” by Commonwealth Bank for the 2022/2023 Financial Year.

- Word of Mouth Service Award in 2020 and 2023.

Your Loan Doctor serves all kinds clients from different walks of life. Profiles of their customers include first-time homebuyers, expats, investors, and returning customers refinancing or expanding their property portfolios.

Phone Number: (04) 06 026 262

Website: yourloandoctor.com.au

2. Blackk Mortgage Brokers

Blackk Mortgage Brokers is a fantastic choice for anyone seeking help securing a home loan. With over a decade of experience, they have a wealth of knowledge and strong relationships with over 40 different banks and lenders.

The mortgage broking professionals’ expertise in modern banking policies means they know which lenders will best suit your personal situation, making it easier to spot the right home loan.

Address: 11/76 Township Dr, Burleigh Heads QLD 4220, Australia

Phone: +61 7 5613 1890

Website: blackk.com.au

3. Professional Lending Solutions

The lending solutions team and Professional Lending Solutions offer exceptional service and solutions. They consider the lender’s costs, service history, and accessibility while getting to know you and your needs. The experienced brokers are part of a large network and receive extensive mentoring to ensure the best interests of the client.

They provide the most up-to-date lending solutions at the best rate and offer convenience by giving you ongoing support. Just leave your information in the Loan Enquiry form below and expect prompt and professional communication. I highly recommend this lending solutions company.

Address: Shop 3D/47 Ashmore Rd, Bundall QLD 4217, Australia

Phone: +61 421 934 033

Website: professionallendingsolutions.com.au

4. Advanced Finance Solutions

Advanced Finance Solutions offers access to loans from leading Australian lenders and work tirelessly to find the right solution for your unique needs. Whether you’re a first-time homebuyer, looking to refinance or invest, they’ve got you covered. They make the entire process easier by managing paperwork and applications from start to finish. Their commitment to client needs and flexibility is unparalleled. Call Advanced Finance Solutions today for an obligation-free appointment at a time and place that suits you.

Address: 708 Southport Nerang Rd, Ashmore QLD 4214, Australia

Phone: +61 7 5613 1888

Website: www.advancedfinance.com.au

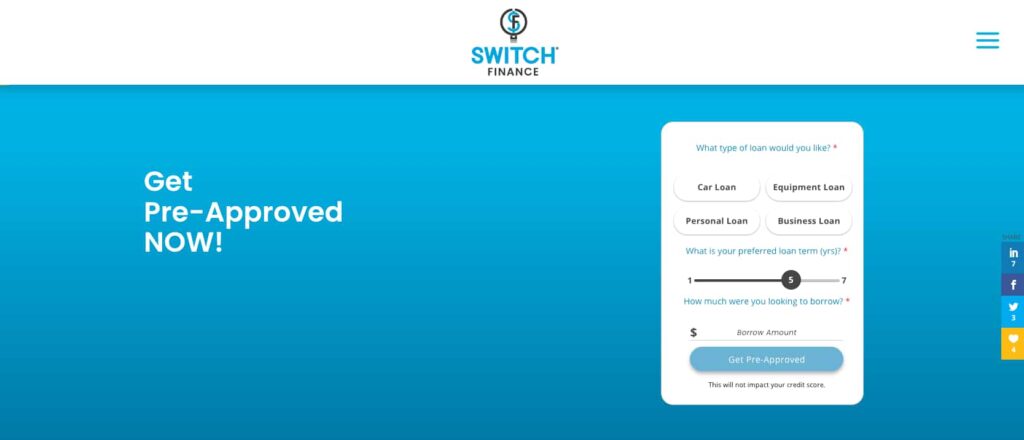

5. Switch Finance

The last company on this list is Switch Finance, a Gold Coast-based loan service that offers a wide range of solutions to clients all over Australia, even those overseas. They specialise in home loans, investment property lending and structure, and business lending, providing tailored solutions in line with your long-term goals.

The mortgage broker Gold Coast team offers expert assistance with equipment finance, small business loans, commercial lending, and more. Their team is ethical and always seeks the best outcome for every client, providing exemplary customer service in a no-pressure environment. Don’t miss out on their services – join the thousands of happy customers who have already made the switch.

Address: 18 Cotlew St, Southport QLD 4215, Australia

Phone: +61 7 5532 0030

Website: switchfinance.net.au

6. Bower & Co

Bower & Co Mortgage Brokers offers personalised mortgage solutions with over 20 years of experience and access to over 60 lenders. They stand out with their 95% loan approval rate in 2022 and an average client loan value of $1.1 million.

Their expertise spans home, investment, commercial loans, and refinancing, catering to both self-employed applicants and traditional borrowers. With a focus on understanding clients’ needs and future goals, Bower & Co ensures a smooth and successful borrowing experience.

7. Nexus Money

Nexus Money simplifies finance with a client-centric approach, boasting over $2 billion in loans settled and access to 60+ lenders. Their expertise spans home, investment, commercial, and vehicle loans, making them versatile in catering to diverse financial needs.

The team is dedicated to providing tailored solutions and bring clients the best possible rates and terms.

8. Go Mortgage

Go Mortgage is an award-winning independent finance broking business based in Arundel, QLD. They cater to a wide range of clients from first home buyers to investors, small business owners, and those needing residential, commercial, SMSF, and asset finance loans. Go Mortgage aims to provide good customer outcomes and deliver five-star experiences.

The finance brokers prioritize clients’ interests and recommend loans appropriate in size and structure, affordable, and compliant with regulations. If you’re looking for a mortgage broker and you value great service and finding the best deal, consider Go Mortgage.

Address: 1/14-28 Ivan St, Arundel QLD 4214, Australia

Phone: +61 1300 855 244

Website: gomc.com.au

How to Choose the Best Mortgage Broker in Gold Coast

here are five key considerations when looking for mortgage brokers to work with:

1. Qualifications

Choose a mortgage broker who is fully qualified and licensed to operate in your area. Check for certifications such as membership in the Mortgage and Finance Association of Australia (MFAA) or the Finance Brokers Association of Australia (FBAA).

These certifications indicate a commitment to industry standards and ongoing professional development.

2. Experience

An experienced broker will have a thorough understanding of various loan products and lender requirements. They can offer valuable insights and advice tailored to your financial situation and goals. Ask about their track record and whether they have handled similar cases to yours.

3. Range of Lenders and Products

Look for brokers who have access to a broad panel of lenders, including major banks, credit unions, and non-bank lenders.

A broker with a wider range of lenders and loan products can provide more options and help you find the best mortgage to suit your needs. Inquire about the lenders they work with and the types of loans they specialise in.

4. Commission Structure

Understand the broker’s commission structure. While many mortgage brokers are paid by the lender and do not charge clients directly, it’s important to clarify any potential fees upfront. Most times, mortgage brokers also get what’s called a trail commission, which is 0.15% of the loan balance each year.

Ask for a clear explanation of how they are compensated and whether there are any additional costs for their services. Transparency in fees helps you avoid unexpected expenses.

5. Communication and Customer Service

Assess the broker’s communication style and customer service. A good mortgage broker should be responsive, attentive, and willing to answer your questions throughout the loan process.

Moreover, your broker should provide clear, straightforward explanations and keep you informed at every step. Consider their availability and willingness to meet your needs and preferences for communication.

Frequently Asked Questions (FAQs)

What Does a Mortgage Broker Do?

A mortgage broker is a finance/mortgage professional who acts as an intermediary between borrowers and lenders. They’re primarily there to help aspiring home buyers and property investors find the best mortgage options. Their services include:

- Assessing Financial Situation: Evaluating your financial status, including income, credit history, and debt.

- Recommending Loan Options: Identifying suitable mortgage products from various lenders that meet your needs.

- Application Assistance: Helping you complete and submit mortgage applications.

- Negotiating Terms: Negotiating favourable loan terms and interest rates on your behalf.

- Managing Paperwork: Handling the administrative tasks and documentation required for loan approval.

By providing expert advice and access to multiple loan products, mortgage brokers simplify the home loan process and help secure competitive rates.

How Much Does a Mortgage Broker Charge in Gold Coast?

Mortgage brokers in Gold Coast, or anywhere in Australia, typically do not charge upfront fees to clients. Instead, they earn a commission from the lender once you get your loan.

This commission is usually a percentage of the loan amount, typically ranging from 0.5% to 1%. Some brokers may charge a fee for their services, especially for more complex cases, but this is less common. We also don’t recommend working with them as you can find those who simply charge a percentage.

Do I Need a Mortgage Broker to Get a Home Loan in Gold Coast?

Final Words

Without a shadow of a doubt, these top five mortgage brokers in Gold Coast have a lot to offer. These are some of the best people in the local finance industry to help you get the right loan to suit your needs. With their expertise and knowledge of the local property market, these brokers are well-equipped to help you navigate the complex world of mortgages and find the best solution for your needs.

We also have a list of the top mortgage brokers in Brisbane if you’re looking for an independent mortgage broker or company in that area. If you need financial planning, you might also want to check out this list of the best financial planners in Brisbane.

Each of the Gold Coast mortgage brokers on our list brings something unique to the table. So if you’re looking for a Gold Coast mortgage broker, consider these top performers. We’re confident that you’ll find the right fit for your needs and be well on your way to achieving your property goals.